30 Oct 2020

Grafiek van de Week Fidelity: Correlaties aan de kook

Beste redacteur,

In zijn Grafiek van de Week kijkt Fidelity International deze keer naar de correlaties op de financiële markten, met name tussen aandelen en obligaties. Die correlaties zijn nu zo groot dat het moeilijker wordt om te diversifiëren en dus nemen de risico’s toe, zeker als het opnieuw tot een grootschalige uitverkoop op de beurzen zou komen.

Chart Room: Correlations boil and bubble and may spell toil and trouble

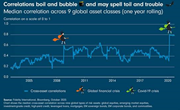

In this follow-up special Halloween edition of Chart Room, we look at how correlations are casting a spell over markets. Bond yields have fallen, while equity markets have rallied since March, bringing cross-asset correlations to a boil. This could bedevil multi-asset portfolios as it reduces diversification opportunities and increases risk, especially in the event of another widespread sell-off.

In a development sure to send shivers down the spines of even seasoned investors, the median correlation across nine types of global risk assets (including equities, credit and commodities) has risen to levels beyond those seen during the global financial crisis and remains at hair-raising altitudes. Bonds ranging from US government to corporate high yield don’t produce very attractive returns at current interest rates. What’s more troubling is whether these asset classes can still offer diversification during periods of drawdowns in equities, which are showing persistently higher volatility than most previous years.

This high-correlation phenomenon is driven in part by the easing actions from the US Federal Reserve and other central banks spooked by the broad sell-offs earlier this year. A key question for investors is whether this activity will prove to be temporary or will mark a more lasting, structural shift.

What is clear is that ongoing economic uncertainties suggest that when the next big test comes, we may see another round of distress selling as in early 2020. In response to the rising correlations and the potential risks this poses, investors would do well to consider a range of possible scenarios for markets and central banks, and then combine elements of protection for each path.

A path through the dark woods

For example, if we see ‘Japanification’, or low/negative yields persisting for decades in the US and Europe, then government bonds should play a defensive role in portfolios as the risk of persistently rising bond yields would be remote. In the case of Japan, shorting its government bonds became known as “the widow-maker” trade.

On the other hand, if growth prospects improve and rates move up in a gradual and well-telegraphed manner, then returns from government bonds will not necessarily be negative as their coupons will offset some of the negative duration impact.

Stagflation is the yet-unseen monster keeping government bond investors up at night. If it rears its head, it may force central banks to raise rates rapidly, in which case government bond returns would come under pressure.

However, central banks may resist raising rates given record levels of debt and fiscal stimulus. If rates (and yields) don’t rise, there would be a limited negative impact on nominal performance; but investors would be worse off in real terms as the value of their assets would depreciate. In this scenario, inflation-linked bonds or inflation break-evens should offer some protection.

Nothing can prepare a portfolio for the zombie apocalypse. But combining assets with different triggers for defensiveness, such as moves in rates, liquidity and correlations, can help to increase overall portfolio resilience. Investors ignore the looming spectre of rising cross-asset correlations at their own risk.

Notes to editors

Voor meer informatie:

Stampa

Lieke Liefkes +31(0) 20 404 2630

fidelity@stampacommunications.com

This material is provided to you in your capacity as media agency/journalist. The material serves exclusively as background information. Rewriting of content is under your responsibility unless otherwise agreed.