06 Nov 2020

Grafiek van de Week Fidelity: Marges onder druk

Beste journalist,

Wanneer de kosten stijgen en tegelijkertijd het prijszettingsvermogen van ondernemingen daalt, komen de marges onder druk. De maandelijkse rondgang onder analisten van Fidelity International geeft inzicht in welk soort bedrijven te kampen hebben met een dergelijke combinatie van inflatiedruk en verminderde mogelijkheden om de prijzen aan de passen.

De Grafiek van de Week van Fidelity International gaat in op het debat over deflatie versus desinflatie, en wat dit voor de bedrijfsresultaten zou kunnen betekenen. Momenteel is er enige onenigheid tussen de marktdeelnemers over de vraag of we te maken hebben met een inflatoire of desinflatoire omgeving. Volgens de analisten van Fidelity International zijn beide scenario's in het spel, waarbij de inflatiedruk van sector tot sector varieert.

De marges in de financiële sector en die van de duurzame consumptiegoederen lijken het meeste gevaar te lopen. Bedrijven in deze sectoren hebben hun prijszettingsvermogen sinds het begin van het jaar aanzienlijk zien dalen. Ultralage rentes hebben veel financiële bedrijven geraakt. De lockdowns deden de duurzame consumptiegoederensector geen goed. In de technologiesector en gezondheidszorg ziet het ernaar uit dat de marges zullen toenemen.

Hieronder vindt u het hele bericht:

Chart Room: Some sectors may be set for a margin squeeze

Rising cost pressures and a drop in pricing power are a recipe for a margin squeeze. The latest reading from Fidelity International’s monthly analyst survey shows which companies are struggling with inflationary pressure but also weaker pricing power.

This week’s Chart Room takes a fresh look at the ongoing debate over deflation vs. disinflation, and what it could mean for corporate bottom lines.

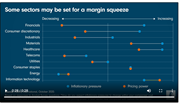

By extracting bottom-up, global data from Fidelity International’s most recent monthly analyst survey, we gauge the inflationary pressures facing companies across 10 key sectors - and compare this with how their pricing power has been affected by the fallout from the Covid-19 pandemic. Those sectors with a large mismatch, such as financials and consumer discretionary, could be in for a squeeze on margins.

In the October Survey, Fidelity’s analysts were asked whether they expect the companies they cover to face any cost price inflationary pressures in the next six months. There is currently some disagreement between market participants about whether we are facing an inflationary or disinflationary environment and our analysts’ responses suggest both scenarios are in play, with inflation pressures varying across sectors.

We also asked our analysts how their companies’ pricing power had been affected by the pandemic. By combining data from the two questions, we can build a picture of which sectors could face pressure on margins - and which could see their margins expand.

Margins in the financials and consumer discretionary sectors appear most at risk of a squeeze. Firms in both sectors have seen their pricing power fall significantly since the beginning of the year. Ultra-low rates have hurt many financial companies, while lockdowns have hit many parts of the consumer discretionary sector the hardest.

The technology sector, on the other hand, looks poised to see margins increase. Pricing power has strengthened since the beginning of the pandemic, outstripping our analysts’ views of cost inflation in the sector. Pricing power has also risen among healthcare and materials companies, not as much as inflation expectations, but it does provide an indication of where opportunities lie.

Contact:

Stampa

Lieke Liefkes

fidelity@stampacommunications.com

+31 20 404 2630