27 Nov 2020

Grafiek van de Week Fidelity: Olie vs goud - twee kanten van de heropening van de wereldeconomie

Fidelity International kijkt deze week in haar Grafiek van de Week naar de afvlakking van de goudprijs en de opleving van de olieprijs. De omgekeerde correlatie tussen de twee suggereert dat beleggers rekening houden met een heropening van de wereldeconomie en het opheffen van reisbeperkingen dankzij de covid-19-vaccins die binnenkort beschikbaar zijn.

Olie en goud zijn de Jekyll en Hyde van de financiële markten: olie heeft de neiging om goed te presteren in tijden met een sterke economische vraag naar goederen en diensten. Goud wordt vooral ingezet als waardeopslag ter bescherming tegen inflatie. Toen de coronapandemie de wereld begin 2020 tot stilstand dwong, werd de relatie tussen olie en goud tot nieuwe extremen opgerekt: de goudprijs steeg terwijl de olieprijs daalde.

Fidelity International ziet echter positieve vooruitzichten voor olie op korte termijn. De ontwikkeling van covid-19-vaccins kan helpen de vraag naar olie te herstellen tot bijna het niveau van vóór de pandemie. Door een beperkt aanbod wegens gebrek aan kapitaalinvesteringen in de productie in de VS en Europa, kan de oliemarkt in de tweede helft van 2021 verkrappen waardoor een opwaartse druk op de olieprijzen kan ontstaan.

Goud heeft eerder dit jaar een enorme vlucht genomen, mede door de verwachting dat de rente lang laag zal zijn, maar de prijsopstuwende krachten lijken af te nemen. Hoewel er bij goud nog steeds bottom-up alfa-kansen bestaan, denkt Fidelity dat de goud/olie-ratio volgend jaar waarschijnlijk verder daalt naarmate de heropening van de wereldeconomie op gang komt.

Hieronder vindt u het volledige bericht:

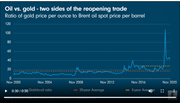

Chart Room: Oil vs gold - two sides of the reopening trade

This week’s Chart Room looks at the recent pullback in gold prices and rebound in oil prices. The inverse correlation between the two suggests that investors are playing two sides of the same trade, sizing up the prospects for a reopening of the global economy and the lifting of travel restrictions on the back of groundbreaking Covid-19 vaccines.

Oil and gold are the Jekyll and Hyde of financial markets; historically, one twists while the other turns. Oil tends to perform well in risk-on environments with strong economic demand for goods and services. Gold by contrast can play an opposite role as a hedge during risk-off times, as well as a store of value when inflation is running high.

Enter 2020, when the economic fallout during the early days of the global pandemic stretched the inverse relationship between oil and gold prices to new extremes. Unprecedented monetary stimulus was unleashed as global travel ground to a standstill, and gold prices surged while oil prices slumped. Previous cases where the gold-to-oil price ratio spiked upwards include the 2008 Global Financial Crisis, and a period in 2014-2015 when Saudi Arabia unexpectedly increased oil production causing its price to crash.

But more recently, we think the near-term outlook for oil is becoming more constructive. The development of vaccines for Covid-19 and the resulting utilisation of spare economic capacity could help oil demand recover to near pre-pandemic levels. Meanwhile, supply is likely to be constrained by a lack of capital investments in production in the US and Europe. As a result, we think the oil market could tighten in the second half of 2021, putting further upward pressure on prices.

Gold, on the other hand, has been on a massive run this year, helped by expectations of low-for-longer interest rates - but the drivers for further gains appear to be on the wane. With the prospect of a rebound in global demand for travel and cross-border trade, it is difficult to see meaningful downside to real yields from here.

Meanwhile, with fiscal balance sheets stretched as they are globally, it’s unlikely economic growth will be robust enough to drive nominal yields to pre-Covid levels and there is a continuing question mark around the Fed’s ability to drive inflation to levels not seen in the recent past. These factors diminish the immediate allure of gold’s perceived value as an inflation hedge.

Although our base case for gold is still higher for longer, and bottom-up alpha opportunities still exist within the gold space, we think the gold-to-oil ratio probably has further to fall next year as the reopening trade gets underway.

Notes to editors

Voor meer informatie

Stampa

Lieke Liefkes

+31 (0)20 404 2630

fidelity@stampacommunications.com

This material is provided to you in your capacity as media agency/journalist. The material serves exclusively as background information. Rewriting of content is under your responsibility unless otherwise agreed.