07 Sep 2020

UBS Asset Management’s S&P 500 ESG ETF reaches USD 1 billion

The first exchange-traded fund (ETF) to integrate a socially responsible investing filter to the S&P 500 equity index has passed the mark of USD 1 billion in assets under management. The landmark solidifies the UBS ETF S&P 500 ESG UCITS ETF as the largest ETF tracking the ESG version of the renowned index.

- The world's first ETF tracking the sustainable version of the renowned index is also the largest, surpassing the USD 1 billion landmark

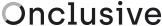

- The ESG fund has outperformed the standard S&P 500 index since inception by more than 550 bps, and has also proven its resilience during the Covid-19 drawdown

- UBS AM is the second largest European provider of ESG ETFs, with USD 16 billion in AuM

The ETF enables investors to get similar exposure to the S&P 500 equity index, while enhancing its sustainability profile. It applies a ‘light green’ ESG screen by excluding around 25% of the market cap of the parent index based on various ESG criteria and can be seen as an ESG alternative to a core equity allocation within portfolios.

The performance of the index tracked by the fund has been impressive since its launch in March 2019. The cumulative outperformance of the S&P 500 ESG index in comparison to the S&P 500 index has reached 550 bps (equivalent to 350 bps per annum). Attribution results indicate that this outperformance is well diversified across sectors and primarily stems from the selection of higher ESG-rated companies. For a portfolio with an active share of 25%, covering broad US equities, it is a very solid investment outcome, highlighting the potential benefits of ESG investing.

The UBS S&P 500 ESG ETF was the first passive fund in the world that offered exposure to an ESG-screened version of the S&P 500 index, and therefore has the most established track-record in this category. It is also the largest fund tracking a sustainable version of the S&P 500 index globally. UBS AM was convinced from the start that investors wanted a sustainable option to invest in the S&P 500 index portfolio, since it is the most popular and renowned index in the world, tracked globally by passively-managed assets of USD 4.6 trillion.

Florian Cisana, Head of ETF & Passive Sales Strategic Markets EMEA at UBS Asset Management, said: "Over the last 10 years we’ve built a sustainable ETF product shelf tailored to meeting investors’ different needs. Our funds provide a range of ‘shades of green,’ offering clients the opportunity to select the best solutions for their portfolios. As investor demand for sustainable products continues to grow, the S&P 500 ESG ETF will remain an excellent option for those seeking an ESG solution for accessing this key US Equities portfolio building block.”

Reid Steadman, Global Head of ESG Indices at S&P Dow Jones Indices, said: “We are pleased to see investors quickly adopting the S&P 500 ESG index as the leading independent ESG benchmark for US equity. The strong demand for ESG index-based portfolios underscores our belief that investors will continue to integrate ESG values into the core of their investments.”

The UBS ETF S&P 500 ESG UCITS ETF is listed on four exchanges (SIX Swiss Exchange, Xetra, London Stock Exchange, Borsa Italiana) and offered in three currency-hedged share classes (EUR, CHF and GBP), as well as in the unhedged USD share class.

Key points at a glance

- The market for standard S&P 500 UCITS ETFs in Europe is approximately USD 130 billion.

- The ESG/SRI segment is the fastest growing theme in UCITS ETFs, now approaching USD 60 billion in assets.

- S&P 500 ESG Index targets sector neutrality vis-à-vis the S&P 500 Index and aims to deliver a tracking error below 100bps.

- S&P 500 ESG Index had 310 constituents, compared to the 505 constituents contained in the S&P 500 Index (July 2020).

|

Fund details: |

||||

|

Funds name |

Nav Ccy. |

Fee |

ISIN |

Bloomberg |

|

UBS ETF (IE) S&P 500 ESG UCITS ETF |

USD |

0.12% |

IE00BHXMHK04 |

S5SD GY |

|

UBS ETF (IE) S&P 500 ESG (hedged to CHF) UCITS ETF |

CHF |

0.22% |

IE00BHXMHN35 |

5ESGS SW |

|

UBS ETF (IE) S&P 500 ESG (hedged to EUR) UCITS ETF |

EUR |

0.22% |

IE00BHXMHQ65 |

S5SG GY |

|

UBS ETF (IE) S&P 500 ESG (hedged to GBP) UCITS ETF |

GBP |

0.22% |

IE00BHXMHR72 |

5ESG LN |

Press contact:

Stampa

Anke Claassen

+ 32 (0)486 46 34 08

UBS@stampacommunications.com

About UBS Asset Management

Asset Management is a large-scale asset manager with a presence in 22 markets. It offers investment capabilities and investment styles across all major traditional and alternative asset classes to institutions, wholesale intermediaries and wealth management clients around the world. It is a leading fund house in Europe, the largest mutual fund manager in Switzerland, the second largest fund of hedge funds manager and one of the largest real assets investment managers in the world.

Disclaimer

This document is for press only and should not be distributed to or relied upon by Retail Clients under any circumstances.

This material supports the presentation(s) given. It is not intended to be read in isolation and may not provide a full explanation of all the topics that were presented and discussed. Care has been taken to ensure the accuracy of the content, but no responsibility is accepted for any errors or omissions. Please note that past performance is not a guide to the future. The value of investments and the income from them may go down as well as up, and investors may not get back the original amount invested.

This document is a marketing communication. Any market or investment views expressed are not intended to be investment research.

The document has not been prepared in line with the FCA requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Source for all data and charts (unless otherwise stated): UBS Asset Management. The information contained in this document should not be considered a recommendation to purchase or sell any particular security and the opinions expressed are those of UBS Asset Management and are subject to change without notice. Furthermore, there can be no assurance that any trends described in this document will continue or that forecasts will occur because economic and market conditions change frequently. This document does not create any legal or contractual obligation with UBS Asset Management. The recipient agrees that this information shall remain strictly confidential where it relates to the Investment Manager's business. The prior consent of UBS Asset Management (UK) Ltd should be obtained prior to the disclosure of commercially sensitive information to a third party (excluding the professional advisors of the recipient).

Information reasonably deemed to be commercially sensitive and obtained from UBS Asset Management (UK) Ltd should not be disclosed.

This information is supplied with a reasonable expectation that it will not be made public. If you receive a request under the Freedom of Information Act 2000 for information obtained from UBS Asset Management (UK) Ltd we ask that you consult with us. We also request that any information obtained from UBS Asset Management (UK) Ltd in your possession is destroyed as soon as it is no longer required.

UBS Asset Management (UK) Ltd is a subsidiary of UBS AG. Registered in England. UBS Asset Management (UK) Ltd and UBS Asset Management Funds Ltd are authorised and regulated by the Financial Conduct Authority. UBS Asset Management Life Ltd is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Telephone calls may be recorded.© UBS 2020. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

The "S&P 500 ESG Index” is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by UBS AM. S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by UBS AM. The UBS S&P 500 ESG ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 ESG Index.